When trading in the live markets you have probably noticed you can execute a trade at a market level or through a buy limit or buy stop. Now the question for beginners is what is the difference between these market executions?

To make this easy and as simple to understand, the following is the types of market orders you can execute:

- Market Buy – Instant purchase to go long

- Market Sell – Instant purchase to go short

- Buy Stop – Purchase to go long at a price determine level

- Buy Limit – Purchase to go long at a price determine level

When using the market buy or sell level you are purchasing your desired instrument at the market price this can fluctuate depending on how volatile the current market is. This option is what most traders utilize as you can quickly purchase or sell an instrument once all your other technical factors line up when analyzing your charts.

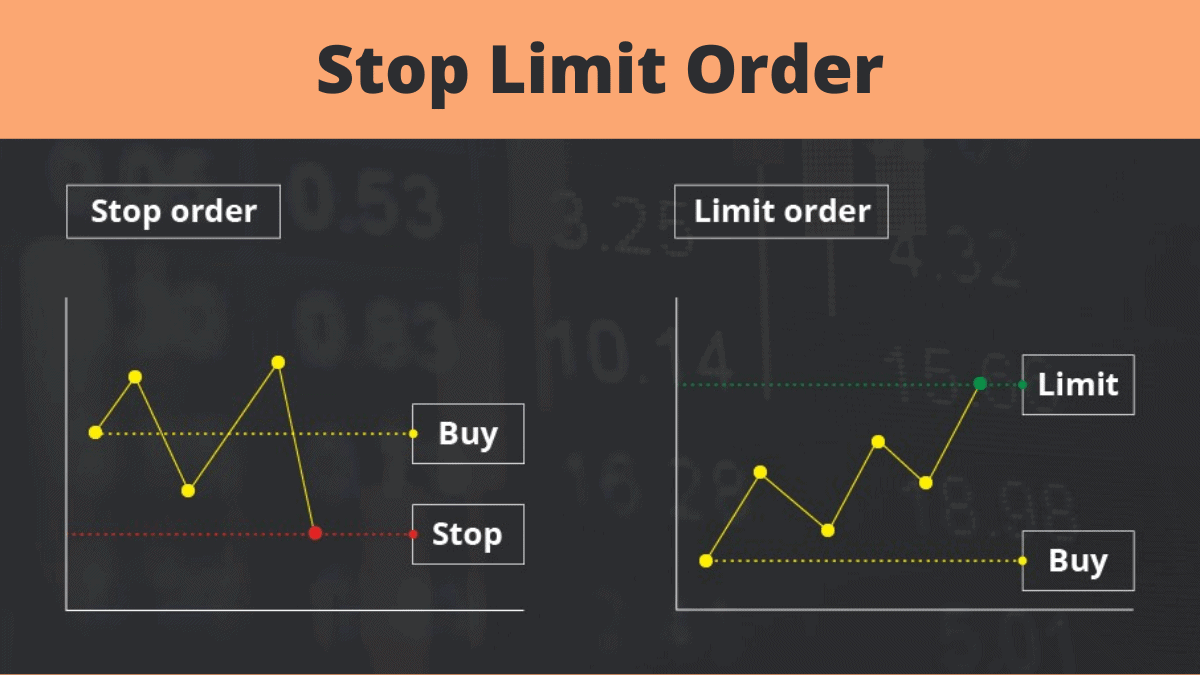

How Does a Stop Order Work?

A stop order is similar to executing at a market level, the only difference is that the instrument will only go long or short (depending what you set it as) once price in the market has hit a certain price. For example, if you’re trading BTCUSD and you only want to go long once price hits $44,500, you will create a buy stop order at $44,500, what will happen is once price hits this level you will be triggered into the trade and have purchased bitcoin at that level going long.

How Does a Buy Limit Order Work?

A buy limit order works almost the same as a stop order the only difference is that you set a price as to the maximum or minimum, you’re willing to execute a trade at. This option will ensure your order will execute at a minimum and maximum level however your trade may not execute if price doesn’t go above or below your desired price.

Other benefits of buy limit and buy stop orders is that you can set your pending orders and do not need to watch the charts all day to execute a trade as it executes it for you automatically once price triggers at your desire level. However as the markets can be very volatile at different times your buy/sell stop order can either be ignored or just not fulfilled at all and that’s where market execution is more advantageous in that aspect.