Support and resistance are a common term you will hear in your trading career and one of the first major trading concepts you will trade off. Now there is many ways to trade support and resistance but before we get into that you must learn the difference between the two.

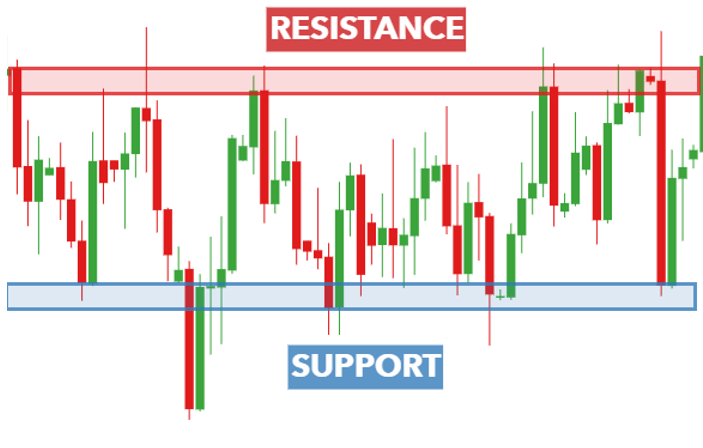

Support areas as seen in the graph below act as a floor that you cannot break through, this is due to the number of buyers purchasing the instrument or going long in this zone. This causes prices to shoot up as the buyers create enough liquidity and momentum for the bulls to go long, it also means that there are protentional buy stop orders at that region and market executions being ready to trigger.

Resistance areas are basically the opposite, think of it as a ceiling that you cannot break through. This is due to an immense of number of sellers selling at that area with market execution orders or sell stop orders, with enough liquidity and momentum the sellers will be in control and price will drop lower.

How To Trade Support and Resistance?

Trading support and resistance is quite easy however with some trading techniques patience is the biggest factor.

The main ways to trade support and resistance is:

- Trading the breakout

- Trading the re-test

Trading the breakout is where you purchase or sell an instrument once it breaks the resistance or support area. Advantages is that with enough liquidity and momentum with your current instrument it can allow you to catch nice small wins without much analysis. However, the drawbacks is that your stop loss is smaller and price may reverse any second as you are hitting an area that is full of either sellers or buyers.

Trading the re-test is quite simple, as seen in the graph below you wait for price to either breakthrough a support or resistance zone and come back to test the effectiveness of the zone. If price starts bouncing away or leaves a wick it shows that either the buyers/sellers have enough purchasing pressure allowing a new support/resistance to be formed. The benefits of this trading technique is that your stop loss is safer, you can determine if there is purchasing pressure and can catch larger moves in the market. The main disadvantages is that price may sometimes not create a pullback which will leave you with no trade to execute and also requires patience even up to a few hours for price to retrace back to your support/resistance level.

Should I trade the Breakout or Re-test?

It depends what kind of trader you are, if you want to scalp make some easy profits then leave the market after a few minutes or an hour then trading the breakout is the best for you. However, if you want a safer approach with your capital with the ability to catch larger moves then becoming a re-test trader will be more beneficial for you.

When you start analyzing charts everyday and start to get the hang of trading breakout and re-tests you can trade either depending on what the market data is providing you. For example, if the market is very bullish and there is immense momentum for buying pressure then trading the breakout would be a good idea in that scenario but it just depends on the current live markets and the instrument you’re trading.