Have you heard the saying ‘the house always wins’ well in the live markets you’re up against other traders, banks, intuitions and other wealthy people that can change the direction of the market with their capital or influence within politics.

While you’re trying to gather confluence to take a trade many traders forget that trading forex, bitcoin or stocks isn’t definite you don’t know where the market is going to go you only have a trading plan or an idea. You may be thinking what is wrong with this, the issue is that without proper risk management you might end up losing all your capital.

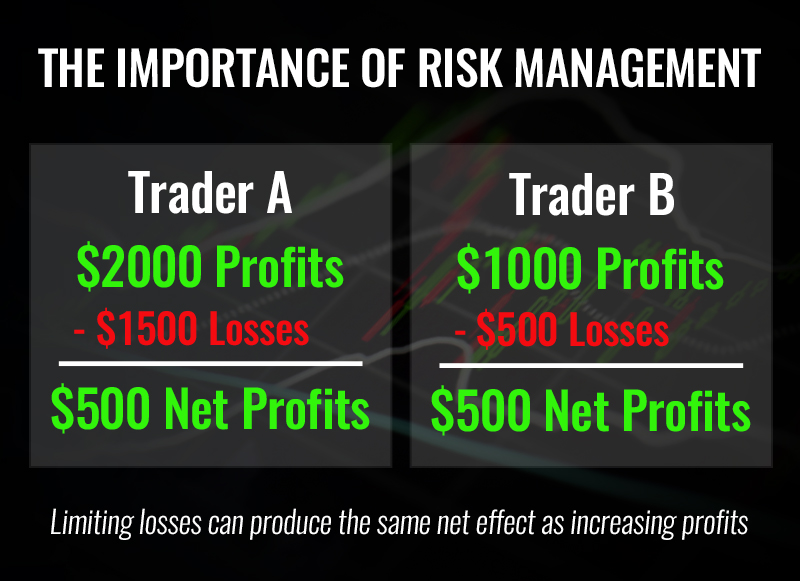

So how do we prevent this from happening? This is where risk management comes into play to ensure you’re not gambling your money but instead managing your risk so that in turn with whatever strategy you’re using you will not end up losing all your capital in one hit, this will allow you to be profitable long-term.

How To Manage Risk

When managing risk it is vital to understand the amount of capital you currently have and how much you’re willing to risk. We recommend to only risk 1% of your capital and at the most 2% of your capital.

For example if you have a trading capital of $100,000 it is fine to risk 1% of your capital incase you get stopped out by the markets or if price hits your stop loss, due to you only risking 1% you have only lost $1,000.

Now how does long term profitability work from this model?

For example if you have a minimum risk/reward ratio of 1:2 which means at the minimum you will be excepting double your 1% risk you can see profitability even with a small win-rate of 30-40%, because even though you’re losing more than winning, due to your risk/reward ratio being higher and only setting a max loss of 1% your profit will outweigh your losses.

If you take 10 trades and only win 4 of them (40% WR) you are obviously in drawdown of approximately $6,000. However if you risk/reward ratio is at a minimum of 1:2 it means that although you have won 4 trades due to it being double your risk you have actually made $8,000.

Therefore if you only won 4 trades at a 1:2 you have made $8,000 minimum. Given that you have lost 6 trades and only risked 1% you have lost $6,000. However, when subtracting our profit from our loss you can see that we are in the positive $2000. This is because $8000-$6000=$2000, this will in turn make our $100,000 capital now $102,000.

When utilizing risk management and a minimum aim of a 1:2 risk to reward ratio you can see that you can maintain profitability given that your strategy works 3-4 times out of 10. Not only does using this method keep you profitable but it makes you a disciplined trader where you’re not risking more than you need and with the power of compounding capital you can see your account grow as the months go on.