It’s no surprise that beginner traders fail at being profitable for the first 6 months this is large in due to over leveraging, lack of information and psychology problems. Finding these flaws in yourself as a trader is a great building block to becoming disciplined which in turn makes you much more confident when taking a trade and leads you to become profitable.

Over Leveraging Account Size

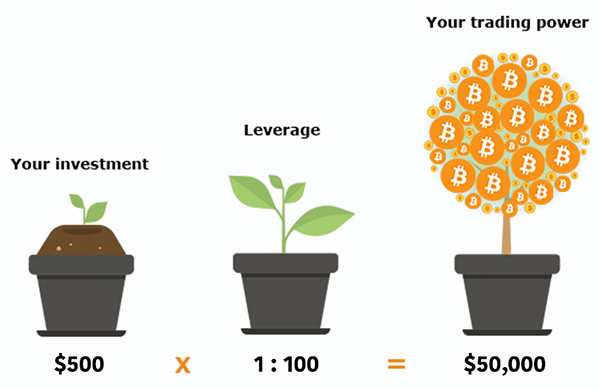

As mentioned in one of our articles profitable experienced traders only risk 1-3% of their account at any given time depending on the setup, so why do newbie traders risk 20% or even more? This is because newbie traders realize that risking a larger percentage will in return give them greater profits in such a small amount of time, the problem with this is given that you are risking 20% of your account if you lose 5 trades in a row you have lost your whole account.

When the pros only risk 1% you are only looking at 5% of their capital wiped off not their whole account! This is what separates a disciplined professional trader from a newbie, they know that if they remain profitable and with compounding, they can grow their account even with losses.

Lack of Information

Although there is a lot of trading information out there on the internet for newbies to learn it may be overwhelming as there is a multitude of information and different trading strategies to learn. This can lead to information overload where newbies look over vital information and try to conquer the live markets themselves and without knowing proper risk management blow up their account within a few hours.

With proper information and a guide that can teach newbies about leverage, position sizing and a basic understanding of market structure all this can be avoided but it depends how much the newbie is willing to learn and practice. Just like life people take the shortcut and burnout and others take the slow route and learn and practice until they get it right, this can be the same in the live markets where you can practice on a demo account before taking your money on the live markets.

Trading Psychology

Psychology is one of the biggest reasons why newbie traders fail this is due to lack of information regarding this subject and newbies not realizing that psychology in the market can cause losing streaks and winning streaks.

For example, if a newbie trader takes out a few trades and loses every single one of them you can bet they will be angry and overleverage their next trade (revenge trading) to make up their losses, which in turn leads to another loss and an account blown up. With correct psychology the newbie trader could take a step back from the computer and evaluate the situation and to continue with his trading plan saving him from destroying his account.

Professional traders don’t allow negative losing streaks to affect them as they know a winning trade is around the corner and with the correct risk management they will be able to cover their losses and more with only a few trades.

It is best for newbie traders to take it slow and easy and to learn and analyze the markets before they dive straight in, for example opening up a demo account and practicing for a few months will yield much better results then jumping straight into the live markets. Just remember slow and steady wins the race especially in the trading market.