When most traders first learn to trade or analyze the markets they find that moving average or EMA indicator to be an easy and useful indicator to use to predict future price moves and to determine whether to go long or short.

The moving average indicators are easy to use for beginners as essentially it’s a line on the graph showing a dynamic support/resistance that can bounce off to either go long or short, given that this indicator can be used at all timeframes it makes it an easy tool for beginners and experienced traders to use.

What Exactly is a Moving Average?

The moving average indicator shows the last x days of average price within the graph you’re looking at and it gets plotted as a horizontal line showing down below.

There are many different types of moving averages there is:

- Smooth Moving Average

- Simple Moving Average

- Exponential Moving Average

The most used day type of moving average is:

- 50 Day SMA

- 100 Day SMA

- 200 Day SMA

When using a 50 day SMA is calculates the average price within the last 50 days, this is great for recent price action and quick intra-day trades. When using the 100day/200day SMA they’re better for swing trading as it is a slower moving average which can help you catch larger moves in the market without much time analyzing the charts.

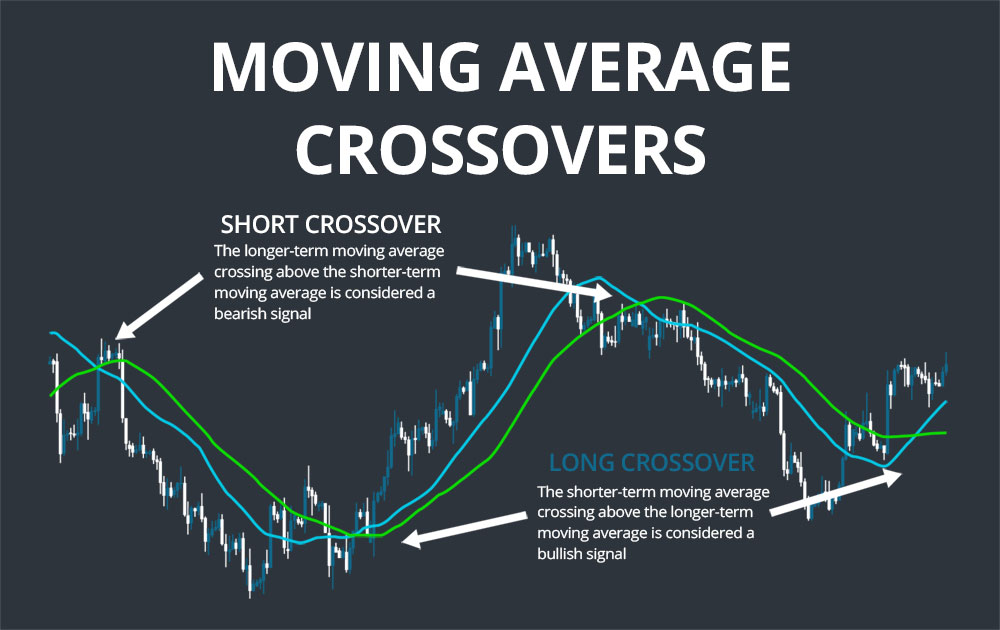

Moving Average Crossovers

The great thing with most trading platforms you can utilize all the moving averages on the graphs at once, in the picture down below you can see the three different types of moving averages on the chart.

The benefit of EMA crossovers is that if the price is above 2 or three of your chosen crossovers it calculates that the trend in the current market is trending upwards, with vice-versa the market trending lower.

Key Notes

Although the EMA can provide a dynamic support and resistance for traders to utilize it must be remembered that it shows the average price of the instrument you’re trading and shouldn’t be used as an indicator on its own. When using this indicator it is best to use this tool with others and current price action to determine where price can move to next.